France

Synthesis

major macro economic indicators

| 2020 | 2021 | 2022 | 2023 (e) | 2024 (f) | |

|---|---|---|---|---|---|

| GDP growth (%) | -8.0 | 7.0 | 2.5 | 0.8 | 0.7 |

| Inflation (yearly average, %) | 0.5 | 1.6 | 5.9 | 5.5 | 3.5 |

| Budget balance (% GDP) | -9.0 | -6.5 | -4.7 | -4.9 | -4.7 |

| Current account balance (% GDP) | -2.5 | 0.4 | -2.0 | -1.2 | -1.2 |

| Public debt (% GDP) | 115.0 | 112.8 | 111.6 | 109.9 | 110.1 |

(e): Estimate (f): Forecast

STRENGTHS

- Quality of infrastructure and public services

- Skilled and productive workforce, robust demographics

- Tourism powerhouse

- Competitive international groups (aerospace, energy, environment, pharmaceuticals, luxury goods, food processing, retail)

- Global agricultural powerhouse

- High level of savings

WEAKNESSES

- Insufficient number of exporting companies, loss of competitiveness and market shares. Structural trade deficit

- Advanced de-industrialisation, relatively low level of product range, insufficient innovation efforts

- Low employment rate for young people and senior citizens

- Relatively inefficient public spending and high tax burden

- High and growing public and private debt

Risk assessment

Stagnating activity and persistent inflation

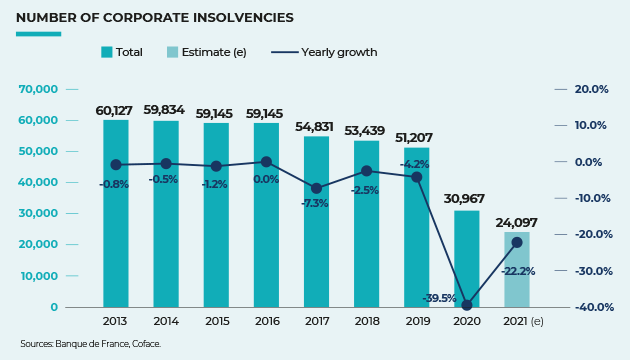

The economy slowed sharply at the end of 2022 and the beginning of 2023, due to sluggish domestic demand against a backdrop of persistent inflation. While limiting the rise in gas and electricity prices (energy price cap) enabled the country to post the lowest inflation rate in the European Union over 2022 as a whole, the lifting of the fuel rebate and the 15% rise in electricity and gas tariffs on 1 January 2023 fuelled inflationary pressures during the first half of the year. Owing to price rises taking root (underlying inflation of 5% in July 2023) and wage acceleration (+4.6% in the second quarter of 2023), inflation should ease very gradually in the second half of 2023. In 2024, wage increases should, all told, be slightly higher than falling inflation, so that households will see their purchasing power rise again. While the uncertain environment will remain conducive to precautionary saving, household consumption should rebound. However, at the same time, households’ property investment, which has been falling steadily since mid-2022, will remain at half-mast in an adverse environment in which the ECB will keep interest rates very high until (at best) the second half of 2024. Restrictive financing conditions (in terms of both interest rates and lending criteria) will also have a considerable impact on businesses, which will have to cope with persistently limited demand, even as their costs continue to rise (accelerating wages, repayment of government-guaranteed PGE loans). Under these conditions, despite a marked slowdown in investment and hiring, business margins and cash flow will be under pressure. Business insolvencies, which began to rebound in 2022 after two years of historically low figures, returned to their pre-pandemic level in the first half of 2023 (up 2% on 2019). As the companies affected are on average larger, the financial cost is much greater. While the rise in imports will be limited by the sluggishness of domestic demand, exports will still be driven in 2024 by the gradual normalisation of the important aeronautical sector. Foreign trade should therefore continue to make a positive contribution to growth, despite the relative stagnation of activity in France’s main partner countries.

Durably high public deficit

After rising sharply as a result of the Covid-19 pandemic and the measures taken to deal with the consequences of the war in Ukraine, the public deficit will remain high in 2023 and 2024. Although the measures taken to combat inflation should not be renewed in 2024, the savings made will be largely offset by increases in civil servant salaries, in line with high inflation, and by additional spending on justice, the police, defence and the ecological transition. At the same time, interest charges will continue to rise in line with interest rates and inflation. Public debt will therefore remain very high, and its sustainability will be one of the main challenges even though the European Union budgetary rules, which were suspended in 2020, will resume in 2024.

After soaring in 2022 in the wake of the energy bill, the current account deficit should remain more moderate in 2023 and 2024. With energy prices –particularly gas – still high but far from the record levels of 2022, the balance of trade in goods will show a smaller deficit (1.6% of GDP in the first half of 2023). The surplus on services (0.7% of GDP), which was historically high in 2022 thanks to the recovery in tourism and, above all, maritime transport, where freight rates reached record levels before falling back at the end of the year, should be more moderate. The current account deficit is financed by debt issues or listed shares purchased by non-residents. At the end of March 2023, non-residents held more than half of the securities issued by general government (51%), non-financial companies (56%) and French banks (70%).

No absolute majority for President Macron, and a high risk of political and social instability

In power since 2017, President Macron, leader of the centre-liberal La République En Marche (LaREM) party, was re-elected for a second term in April 2022. Although he again won in the second round against Marine Le Pen of the far-right Rassemblement National (RN), this time the score was much closer (58.5%-41.5%, compared with 66%-34% in 2017). In the legislative elections that followed two months later, his party won a mere 170 of the 577 seats in the National Assembly. After forming an alliance with two other centre-right parties, it won only 250 seats in total and, as such, the government is forced to negotiate agreements on each reform, or pass it without a vote in the National Assembly, leaving itself exposing to a possible vote of no confidence. The main two opposition forces are the RN (88 MPs) and the left-wing alliance NUPES (149 seats, including 74 for the far-left LFI party). Both have tabled numerous no-confidence votes against the government since the start of the second term of office, which gives Les Républicains (right-wing, 62 seats) a central role both in approving reforms and in ensuring the continuity of the government in the event of fresh votes of no confidence motions, which have so far been consistently rejected. However, the failure to get the pension reform law approved in March 2023 despite the support of the Republican leaders illustrates the patchy nature of this group of MPs, which makes it difficult to pass any major reform.

In the event that the government cannot pass certain reforms, President Macron could also dissolve the National Assembly and call for snap general elections. In the absence of an absolute majority for the President of the Republic, the risk of political instability is clearly increased, and no particular scenario can be ruled out. The risk of social tensions is also high, as illustrated by the protests following the adoption of the pension reform without a vote in the National Assembly and, a few months later, the riots in June 2023 following the death of a young teenager.

Last updated: September 2023

Payment

Bank cards are now the most commonly-used form of payment in France, although cheques are still widely used. In value terms, cheques and transfers are still the most popular forms of payment.

If a cheque remains unpaid for more than 30 days from the date of first presentation, the beneficiary can immediately obtain an enforcement order (without need for further procedures or costs). This is based on a certificate of non-payment provided by the creditor’s bank, following a second unsuccessful attempt to present the cheque for payment and when the debtor has not provided proof of payment within 15 days of receipt of a formal notice to pay served by a bailiff (Article L.131‑73 of the Monetary and Financial Code).

Bills of exchange, a much less frequently used payment method, are steadily becoming rarer in terms of number of operations – although they remain important in terms of total value. Bills of exchange are still an attractive solution for companies, as they can be discounted or transferred and therefore provide a valuable source of short-term financing. Moreover, they can be used by creditors to pursue legal proceedings in respect of “exchange law” (droit cambiaire) and are particularly suitable for payment by instalments.

Bank transfers for domestic or international payments can be made via the SWIFT electronic network used by the French banking system. SWIFT offers a reliable platform for fast payments, but requires mutual confidence between suppliers and their customers. France is also part of the SEPA network.

Debt collection

Unless otherwise stated in the general sales conditions, or agreed between the parties, payment periods are set at thirty days from the date of receipt of goods or performance of services requested. Interest rates and conditions of application must be stipulated in the contract – otherwise the applicable interest rate is that applied by the European Central Bank in its most recent refinancing operations. Throughout the first half of the year in question, the rate applicable is that in force on January 1 and for the second half year in question, the rate applicable is that in force on July 1.

Amicable phase

During this phase, the creditor and the debtor try to reach an amicable solution via direct contact in order to avoid legal procedures. All documents signed between the parties (such as contracts and invoices) are analysed. Where possible, the debtor can be granted an extended time period to pay his debts, with the period’s length negotiated as part of the amicable settlement.

Legal proceedings

Order for payment (injonction de payer)

When a debt claim results from a contractual undertaking and is both liquid and undisputable, creditors can use the injunction-to-pay procedure (injonction de payer). This flexible system uses pre-printed forms and does not require the applicants to argue their case before a civil court (tribunal d’instance) or a competent commercial court (with jurisdiction over the district where the debtor’s registered offices are located). By using this procedure, creditors can rapidly obtain a court order which is then served by a bailiff. The defendant then has a period of one month in which to dispute the case.

Fast-track proceedings

Référé-provision provides creditors with a rapid means of debt collection. If the debtor is neither present nor represented during the hearing, a default judgment can be issued. The court then renders a decision, typically within seven to fourteen days (though same-day decisions are possible). The jurisdiction is limited to debts which cannot be materially contested. If serious questions arise over the extent of the debt, the summary judge has no jurisdiction to render a favourable decision. Judgments can be immediately executed, even if the debtor issues an appeal.

If a claim proves to be litigious, the judge ruled competent to preside (juge des référés) over urgent matters evaluates whether the claim is well-founded. If appropriate, the judge can subsequently decide to declare himself incompetent to rule on the case. Based on his assessment of whether the case is valid, he can then invite the plaintiff to seek a ruling through formal court procedures.

Ordinary proceedings

Formal procedures of this kind enable the validity of a claim to be recognised by the court. This is a relatively lengthy process which can last a year or more, due to the emphasis placed on the adversarial nature of proceedings and the numerous phases involved. These phases include the submission of supporting documents, written submissions from the litigants, the examination of evidence, various recesses for deliberations and, finally, the hearing for oral pleadings (audience de plaidoirie).

Proceedings are issued through a Writ of Summons (Assignation) which is served on the debtor 15 days before the first procedural hearing. During this hearing, the court sets a time period for the exchange of pleadings and discovery. Decisions rendered do not necessarily have the possibility of immediate execution. In order to be executed, they must first be served on the debtor. They are also subject to appeal.

Enforcement of a legal decision

Unless the court decision is temporarily enforceable, enforcement can only commence if no appeal is lodged within one month and must occur within ten years of notification of the court’s decision. Compulsory enforcement can be requested if the debtor does not comply with the judgment. Obligations to pay can be enforced through attachment (of bank accounts or assets) or through a third party which owes money to the debtor (garnishment).

France has adopted enforcement mechanisms for decisions rendered by other EU member countries. These mechanisms include the Payment Order under the European Enforcement Order. Decisions rendered by non-EU members can be recognised and enforced, provided that the issuing country is party to a bilateral or multilateral agreement with France. In the absence of an agreement, claimants are obliged to use the French exequatur procedure.

Insolvency proceedings

French insolvency law provides for six procedures to undertake restructuring or avoid insolvency. These are either assisted proceedings or proceedings controlled by the court.

Assisted proceedings

These can be either mandated ad hoc or via conciliation proceedings. Both are informal, amicable proceedings, where creditors cannot be forced into a restructuring agreement and the company’s management continues to run the business. These negotiations are governed by contractual law throughout their duration. The proceedings are conducted under the supervision of a court-appointed practitioner (a mandataire ad hoc, or a conciliator) in order to help the debtor reach an agreement with its creditors. Both of these types of proceedings are confidential but conciliation can eventually be made public if the debtor has the approval of the commercial court. Nevertheless, the terms and conditions of agreements remain confidential and can only be disclosed to signatory parties.

Court-Controlled proceedings

The four types of court-controlled proceedings are judicial reorganisation, judicial liquidation, sauvegarde, and Accelerated Financial Sauvegarde proceedings (AFS).

In all four proceedings, any pre-filed claims are automatically stayed. Creditors must file proof of their claims within two months of publication of the opening judgment, or four months for creditors located outside France. Debts which arise after proceedings commence are given priority over debts incurred beforehand. Certain types of transactions can be set aside by the court, if they were entered into by the debtor during a hardening period (before a judgment opening a judicial reorganisation or a judicial liquidation).

With Court-Controlled proceedings there can be variations in the extent of involvement of the court-appointed conciliator. The sauvegarde and AFS procedures are debtor-in-possession proceedings, but with judicial reorganisation, the court can decide whether to set aside the company’s managers. The role of management is particularly reduced in cases of judicial liquidation, as the debtor company usually ceases to conduct business. Nevertheless, the court can decide for a business to continue operating under a court-appointed liquidator.