Strengths

- General recovery in the sector, coupled with a strong increase in metal prices

- Recovery in demand coming from the manufacturing sector

- Products used in many industries across the world, notably in the manufacture of electrical batteries and aluminium components intended for electric vehicles

- Future opportunities for some metals, such as nickel, with the development of electric vehicles

Weaknesses

- Increased pressure from Chinese authorities to reorganise the iron and steel industry

- Highly dependent on Chinese economic policy

- Push to reduce the environmental footprint of mining and metalworking

Risk assessment

Highlights

Coface anticipates 2022 growth rate to reach 4.1%, after 5.6% in 2021. Demand in the manufacturing sector has rebounded strongly in the richest countries thanks to the mitigation of containment measures. The sustained demand following the easing of the lockdowns created a mismatch between supply and demand, inducing strong pressures on prices. Many base metals suffered years of underinvestment, notably after the “Supercycle”, and as such, all the conditions are met to keep the current imbalance between supply and demand somewhat alive in the forthcoming quarters.

However, in recent months, prices of some metals have fallen from the record highs reached in 2021, notably steel prices in China and in Europe. This suggests that the overall recovery in metals may be stagnating. Markets are anticipating a slowdown in Chinese demand, as authorities want to curb the expansion of the steel sector to meet its greenhouse gas reduction targets. Furthermore, authorities are acting swiftly to reduce speculation around metal prices to help downstream sectors cope with higher input prices, while the construction sector is seen as vulnerable due to difficulties experienced by big real estate and property developers.

Finally, although it is very hard to anticipate trends in details, metal prices, which peaked in 2021, seem to be stabilising now, in line with Chinese demand (50% of world metal demand) that is continuing to grow, but at a slower pace. It should be noted that new waves of the pandemic can occur, and may threaten the global economy and therefore the metals sector.

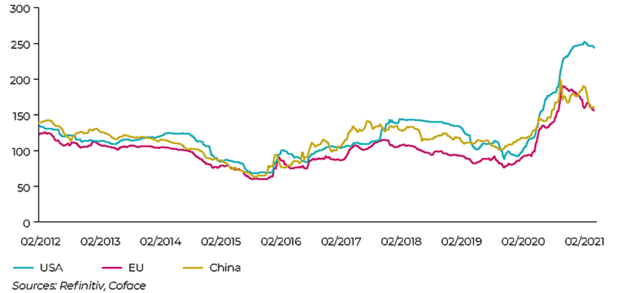

STEEL PRICES EVOLUTION

Sector Economic Insights

Although early in China, the recovery has been widespread thanks to the stimulus plans of the richest countries. Coface estimates GDP growth of 5.4%, 3.7% and 3.7% in 2022 in China, Europe and the United States, respectively.

In 2020, when the COVID-19 pandemic broke out, the metals sector, which is highly dependent on economic conditions, was affected differently across the globe.

According to the Australian Department of Industry, Science, Energy and Resources, global consumption of steel, copper and nickel will grow by 2.7%, 2% and 4.7% in 2022, respectively. General consumption will slow globally as economic activity will shift towards a regime with a lower growth rate. While vaccination rates are increasing, the irruption of a new variant is expected to impact economic activity. Moreover, China policy support for the construction and real estate sectors will be of paramount importance to help sustained metal prices. The current supply chain issues (semis shortage, lack of magnesium, etc.) could well continue into 2022, and affect prices accordingly.

The Chinese recovery, followed by a more global recovery, allowed metal prices to rise. For 2022, prices are expected to stay at high levels due to relatively strong demand and limited supply growth. Years of underinvestment in several segments are posing some limitations on production, while restrictions implemented to contain the spread of new variants could strengthen prices in 2022. However, market balancing could be effective at Q4 2022 if Chinese authorities will not set up an accommodative monetary policy. Finally, an U.S. infrastructure plan could help demand to pick up and thus sustain high levels prices.

The steel industry is decelerating in China

Iron ore and steel are suffering from the slowdown in the Chinese construction sector. High indebtedness in the real estate segment is posing a threat to steel consumption due to lower demand from this side. Twelve months steel production grew by a tiny 4% YoY in China at end September 2021, after double digits growth rates during spring 2021.

The Chinese steel industry is very important to the country’s manufacturing, construction and real estate sectors as it supplies these industries with key products. However, this industry has a great environmental footprint as it pollutes excessively per se, notably private steel mills, and it is energy intensive, requiring huge amount of electricity generally supplied by coal firing power plants. Therefore, the industry is at the forefront of the fight against pollution and for carbon neutrality, as pledged by Chinese top decision makers. We expect steel production in the forthcoming years to be capped to the year before, in an attempt to accelerate towards carbon neutrality. Lastly, and this move could be seen as a revolution in the Chinese steel industry, steelmakers could be forced by planners to adopt more scrap instead of iron ore to produce steel. This would force them to invest into new plants while closing the obsolete ones.

In Europe, steel prices are losing steam. Bottlenecks in the supply chain associated with higher energy costs are affecting steelmakers’ activity. Lack of raw materials, high shipping costs and shortages of key equipment and components will continue to bite the manufacturing sector during 2022. Even if we witness some easing, notably regarding the shortage of semiconductors that is hitting hard the automotive industry, we expect that the conjunction of such headwinds to hamper steelmakers activity.

In the United States, steelmakers are hit by the same headwinds as their European and Chinese counterparts, even though the property market seems resilient. Steel prices are starting to decrease as demand from the manufacturing sector is impacted by lower orders from the automotive industry, and to a lesser extent by capital goods. The implementation of some measures included in the infrastructure plan will help the steel sector, and the metalworking industry as a whole, during 2022. However, the better financial shape of U.S. steelmakers bodes well, but one can remain cautious about the increase in capacity following the enactment of import duties for foreign steel products during the Trump presidency.

Trends in the prices of the main metals reflect the trends of the economic and health crisis. After declining in response to the COVID-19 crisis, prices of major metals are still at high levels. However, according to SteelHome, average monthly steel prices in China, Europe and the U.S. decreased by 7%, 12% and 1% respectively at end November 2021 from their peak of summer 2021.Metal prices are expected to remain stable this year, due to strong demand in client sectors such as manufacturing. Despite the difficulties encountered, the steel industry has remained overall a profitable business in the main markets.

In the medium-term, the need to reduce the sector’s environmental impact and the continued development of electric engines are expected to continue to have a major impact on its business

Many metal producers are heading toward producing more “green” metals, as they pledge to reduce their environmental footprint in order to cut their GHG emissions. This is notably the case for steelmakers in Europe, which are, with the support of authorities, investing large sums of money into projects designed to enable carbon neutrality and reducing their energy consumption or switching to renewables induced electricity generation. As such, the development of wind and solar energy, as well as the democratisation of the electric car, require very large quantities of copper and nickel (amongst others). Such vehicles contain three times more copper than a car with thermal propulsion. For nickel, the differences can vary from between 3 to 30 times, depending on the technologies and technical characteristics of the vehicles. Carmakers, who are looking to reduce the weight of vehicles, will eventually favour aluminium, which is 10 to 40 times lighter than steel, to increase vehicles’ range.

In line with the development of a Green Deal, a programme of investment in green energy promoting energy transition and decarbonisation, the European States are trying to build a consensus to make the continent’s economy sustainable, particularly through the exploitation of natural resources. Thus, the demand for metals such as aluminium, nickel, platinum and palladium, related to electric vehicles will grow in the coming years. We anticipate that small and medium-sized companies in the metals sector will face difficulties, as the sectoral transition will require heavy capital expenditure, to lower the environmental footprint.

Last update : February 2022