Strengths

- Growing interest in biomass energy is helping to sustain demand for wood

- Increasing demand from emerging countries

- Valued due to the rise of sustainable construction aimed at limiting environmental risks

Weaknesses

- Dependent on the construction and paper sectors

- Efforts by sector participants to adapt to stricter regulation of wood harvesting in order to preserve forests

- Highly exposed to climatic hazards and ongoing trade tensions

Risk assessment

Risk Analysis Synthesis

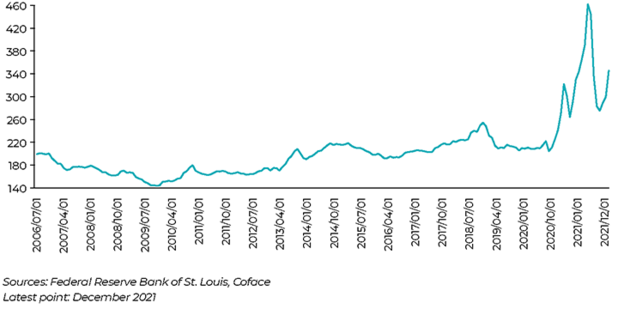

The wood sector is highly dependent on the construction industry, which uses large amounts of wood as inputs. The COVID-19 pandemic had a severe impact on construction, causing worksites to be shut down abruptly. Accordingly, the global economic recovery (5.5% world growth in 2021 and 4.1% in 2022 according to Coface), accompanied by a resumption of both private-sector projects and public infrastructure construction projects driven by stimulus plans, caused demand for wood to explode. This led to a threat of shortages and fuelled an unprecedented surge in wood prices, which skyrocketed by 377% YoY in May 2021, before finally stabilising at the end of 2021 and in 2022. Wood is also highly dependent on the paper sector, which has seen a sharp increase in packaging demand due to the rise of e-commerce. This was a boon for the wood sector during the COVID-19 crisis, but could stoke inflationary pressures in the industry.

The sector is still facing profound transformations. Activity in the industry continues to suffer from protectionist tensions, such as the customs duties imposed by the United States on Canadian lumber since 2017 (after a temporary easing of tensions between the two countries, which saw customs duties cut from 20.2% to 8.9% at the end of 2020, the United States now wants to increase them again to 18.3%) and the trade disputes between China and the United States, which have imposed 25% customs duties on imports of each other’s wood and wood-based products. At the global level, participants are facing an increasingly restrictive regulatory framework due to environmental issues and government measures aimed at preserving forests.

Notes for the reader

Wood pulp: paper pulp; pulp for the manufacture of paper and cardboard

LUMBER, PRICE INDEX (1982 = 100)

Sector Economic Insights

A sector whose difficulties were exacerbated by the COVID-19 crisis, but which is booming because of global demand

Before and during the COVID-19 crisis, the wood sector was hurt by the global economic downturn, due to weaker demand and the industry’s dependence on the construction and paper sectors, which were themselves undermined by slacker economic growth. Since then, the sector has experienced an exceptional rebound thanks to the recovery of the construction industry, to the extent that it is now suffering from shortages that have caused wood prices to explode.

The health crisis had a severe impact on construction, which is the wood sector’s primary client. Since the global economic recovery, driven by Asia and the U.S., construction has resumed after an abrupt shutdown lasting several months. At the beginning of the pandemic, demand for wood was slightly down and mill stocks were reduced. Some companies even stopped production for a few months. The resumption of public and private renovation and construction projects spurred a recovery in activity and a rebound for the sector, with construction growing by 5.2% in 2021, according to GlobalData. This resulted in an explosion in demand for wood, causing delivery delays, scarcities and, above all, a surge in prices. The fact that contracts in the construction sector are often signed months before work begins is complicating matters. The situation is therefore worrying for customers and players in the sector, who face long wait times before taking delivery of their wood orders. However, the construction sector is expected to see a period of flat growth in 2022, particularly in China, which began to emerge from its real estate boom in late 2021.

The wood sector is also dependent on the paper sector, whose packaging segment benefited from strong demand amid the rise of e-commerce due to the mobility crisis caused by COVID-19 and the need to limit physical contacts. This latter development and higher demand for packaging paper stimulated demand for wood. Thus, after declining in 2019 and evening out in 2020, wood pulp* prices soared in 2021, with the St. Louis Fed’s lumber price index up by 107% over one year in August 2021. It is expected to stabilise in 2022.

The lack of transport to get timber from sawmills to traders also played a role in the increase of wood prices, as the pandemic reduced driver numbers and impacted rail transport.

A global trend of price increases and shortages in the sector

In Europe, the sector is affected by the tensions between the United States and Canada. Due to the trade dispute with their traditional Canadian suppliers, Americans are acquiring European logs at high prices. As a result, 9,000 European wood processing companies signed a petition against large-scale log exports to non-European countries. For countries such as France and Germany, demand increased so much that it led to near-scarcity and supply delays in the industry.

Japan, as a big importer, has been severely affected by the rise in wood prices. The country is a special case, as although 70% of the country is covered by forests, Japan is nonetheless one of the world’s largest importers of wood, mainly from the United States and Chile. Japanese wood imports have picked up sharply since the health crisis, further contributing to the rise in prices. The domestic industry is therefore endeavouring to boost demand for Japanese wood.

In China, much of the sector’s demand comes from the real estate market, which rebounded strongly in 2021. The Chinese National Bureau of Statistics announced that between January and May 2021, real estate investment increased by 18.3% compared with the previous year and was 17.9% higher than from January to May 2019. Consequently, the wood sector is growing rapidly, and China is increasing its production area as well as its imports. However, more muted demand in the real estate sector should stabilise demand in construction. China benefited greatly from the global recovery, particularly in terms of demand for wooden furniture, and increased its exports of these products to the U.S. by 125% in Q1 2021.

In the Americas, the recovery in demand for wood is affecting all countries, whether they are consumers or producers. In North America, the U.S. proposal for an increase in tariffs on Canadian lumber (which accounts for 30% of wood consumed in the U.S.), despite the explosion in prices, is straining relations between the two countries. The move comes at a time of strong demand for wood and near-scarcity of the material, driven by the general recovery and particularly the pick-up in the construction sector, but also by consumption of wood furniture products. The situation is forcing major Canadian and U.S. sawmills to consider new investments to meet the strong demand. In July, the U.S. wood product industrial production index hit 219.8, up 56% YoY. Latin America is also benefiting from strong demand for wood. Argentina’s wood industry has committed itself to a 44% increase in wages for employees by 2021. Furthermore, revenues from furniture sales increased by 24.5% in 2021 in Argentina and 20.2% in Brazil.

Ongoing transformations in the sector are expected to continue

The sector remains impacted at this stage by the protectionist environment, notably featuring trade tensions between China and the United States, which have imposed 25% customs duties on imports of each other’s wood and wood-based products. The U.S. wood sector is particularly affected, with 60% of its exports going to China. Between 2017 and 2018, U.S. wood exports to China fell from USD 1.7 billion to USD 1 billion, mainly due to a decline in hardwood, which accounts for the lion’s share of U.S. wood exports to China. The U.S./China trade war has intensified, and tensions between the two countries have increased. This is expected to continue to have a negative impact on the wood sector in 2022.

A sector that is highly sensitive to environmental risks

Wildfires in logging forests, particularly in the western United States and Canada, have threatened part of the continent's wood supply. Timber producers have cut back on mill production as the fires have jeopardised supply chains and transportation.

However, wood is increasingly being used in Europe as a material that could meet sustainable development objectives, especially as a steel replacement in frame construction. Moreover, forestry companies are exposed to environmental factors that could affect the supply of wood. For this reason, forestry investors must now take into account a range of ESG issues in their investment strategies, such as the preservation of biodiversity or relations with local communities.

The issue of deforestation was at the centre of discussions at the COP26 UN Climate Change Conference. The leaders of 100 countries committed themselves to stopping deforestation by 2030 to protect the climate. The joint declaration will be adopted by more than 100 countries that are home to 85% of the world's forests. The European Commission is preparing a draft law to restrict the import of products that contribute to the destruction of forests in their countries of origin. This could have an impact on the supply and quantity of wood sold.

Last update : February 2022